February may be the shortest month of the year, but this February was packed with news in the world of social innovation. In particular, we saw new data, stories and perspectives brought forward in the world of Inclusive Entrepreneurship that we’d like to reflect on and use to power the movement. I spent some time rereading our weekly Case Foundation Breaking Good newsletter to gauge some of the conversation around supporting diverse entrepreneurs this month. Here are some of the articles and trends that stood out to me:

Black History Month is a reminder to uplift Black entrepreneurs—past and present

Every day is a great day to celebrate the achievements of groundbreaking innovators in history and the people who are carrying on their legacies and building their own. But as Black History Month comes to a close, we’re given a renewed commitment to uplift the stories of Black entrepreneurs—sharing both the contributions they bring and the unique challenges they face.

With that in mind, we were inspired by reflections from successful Black entrepreneurs on how they succeeded in a world filled with barriers designed to stifle their progress. One of the Be Fearless quotes that stood out came from Urban One founder, Cathy Hughes:

“[Don’t] let anyone convince you that your dream, your vision to be an entrepreneur, is something that you shouldn’t do. What often happens is that people who are well meaning, who really care for us, are afraid for us and talk us out of it.”

There’s a glaring gap for women entrepreneurs

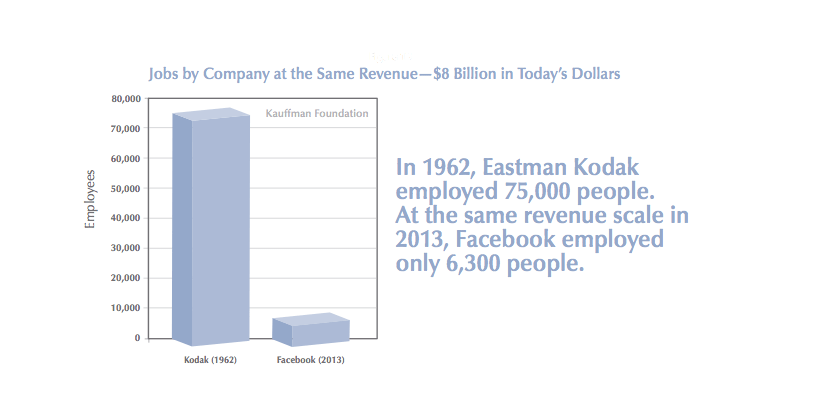

As reports highlighting data on entrepreneurship from 2017 begin to come out, the statistics on women entrepreneurs are disheartening, to say the least. According to Pitchbook, businesses with all-women founding teams received just 2.2 percent of all venture capital in 2017. Teams with a mix of genders received just 12 percent, and a whopping 79 percent of venture capital went to all-male teams (the remaining 7 percent was unreported).

To change these numbers, there isn’t an easy fix. We know where we can start—more women launching businesses, more women in venture capital, fewer cases of bias at the hands of investors—but none of these alone will solve the problem. Partners are stepping up across industries to build solutions together that will collectively challenge the systemic biases that affect how opportunity is distributed in our culture. Data and storytelling can play major role in that, which brings us to our next trend.

We need to support data and storytelling on underrepresented innovators

Sherrell Dorsey is doing just that. Dorsey founded a daily newsletter called ThePLUG to report on founders, investors and innovators of color. This month, she talked to Vice about the need for more data on Black entrepreneurs. This is one of the many great points she made:

“A lot of times, especially in the black community, when you look at entrepreneurship, there’s been very little data collection—like, the kind of businesses we’re creating, the kind of problems that we’re solving. (…) A lot of times investors are looking for patterns in data, so when that information is not shared in public, you get a knowledge gap.”

To extrapolate out from what Sherrell is saying, if investors don’t have the data they are used to having when making investment decisions, they are less likely to fund initiatives. Therefore, having a more robust dataset on Black entrepreneurship could help spark solutions across the board. That’s something we’re working towards as we champion inspiration capital as a core part of our Inclusive Entrepreneurship work. By uplifting the stories of underrepresented entrepreneurs—stories that share both their challenges and their unique insights—we’re hoping to change widespread assumptions about who is and can be a talented entrepreneur.

Entrepreneurship can flourish across in all communities across the U.S.

Another widespread assumption about entrepreneurship we’re working to challenge is the notion that Silicon Valley is the only great place to launch a company. Fortunately, that idea is being challenged by entrepreneurs, investors and ecosystem builders across the country. We loved hearing about how Kela Ivonye, founder of connected delivery storage service, MailHaven found Louisville Kentucky, not Silicon Valley to be the best place to build the company.

On the ecosystem side, we’ve been inspired by news about places like Raleigh, where a program is helping formerly incarcerated individuals pursue entrepreneurship. In the Midwest, a variety of organizations are working to support the region’s female entrepreneurs. And in New York, three of the city’s major banks announced plans to give a combined $40 million to programs supporting women and entrepreneurs of color there.

This month, Engine also interviewed an ecosystem builder in Colorado as part of an ongoing series we love, #StartupsEverywhere, where the outlet talks to the people building entrepreneurial ecosystems across the country. And this week’s Kauffman Foundation newsletter poses important questions on how we can build inclusive ecosystems, including a powerful video by Melissa Bradley on her experiences as an entrepreneur, investor and ecosystem builder.

From celebrating past and present Black entrepreneurs and leaders, to building solutions for female founders, to tackling the data gap, to highlighting innovation everywhere—leaders in the world of Inclusive Entrepreneurship are getting to work. The stories we’ve seen this month inspire us and we can’t wait to read and share even more of these informative and inspirational stories. To learn more, sign up for our newsletter, Breaking Good.

Is there anything we missed this month? Tell us about your favorite social good story you saw in February!