The past few months have been full of news on the growing impact investing sector. Coming off of the announcements earlier this year—Bain Capital starting an impact fund under the leadership of Governor Deval Patrick, BlackRock starting an impact practice and Darren Walker and the Ford Foundation taking leadership of the U.S. National Advisory Board on Impact Investing—Jean Case recently described the increased buzz and activity as A New Inning for Impact Investing. She shares her insights on the growing movement that has until recently been in “spring training,” and an all-star line-up that is now taking shape.

We’ve summarized several key pieces of news from the past few months so you can read all about the latest updates. We look forward to seeing even more momentum this year!

Global Progress on Impact Investing

The Social Impact Investment Taskforce, established under the British presidency of the G8 in 2013, met in London in July to talk about progress achieved by member countries and to discuss what’s next for the group. Private and public sector representatives from G7 countries, the EU, Australia, Brazil, Israel, India, Mexico, Portugal, South Africa, China and others were present. Sir Ronald Cohen, Chair of the Taskforce, opened the Plenary Meeting by saying that “it’s impossible to stop an idea whose time has come,” and country report-outs on progress seemed to strongly support that statement. You can find presentations and reports from the Plenary Meeting on the Taskforce website.

New Report: Impact Investing Can Provide Market-Rate Returns

The Global Impact Investing Network (GIIN) and Cambridge Associates released results from a new study, the Impact Investing Benchmark. The report presents aggregate financial performance from 51 private equity and venture capital impact investment funds that have the intention to generate measurable social impact alongside a financial return. The report reveals that many of the early funds, established between 1998 and 2004, have achieved market rate or above market rate returns, demonstrating that impact investments don’t necessarily require financial sacrifice. GIIN and Cambridge Associates will provide quarterly updates on the benchmark.

Mixed Results for Social Impact Bonds

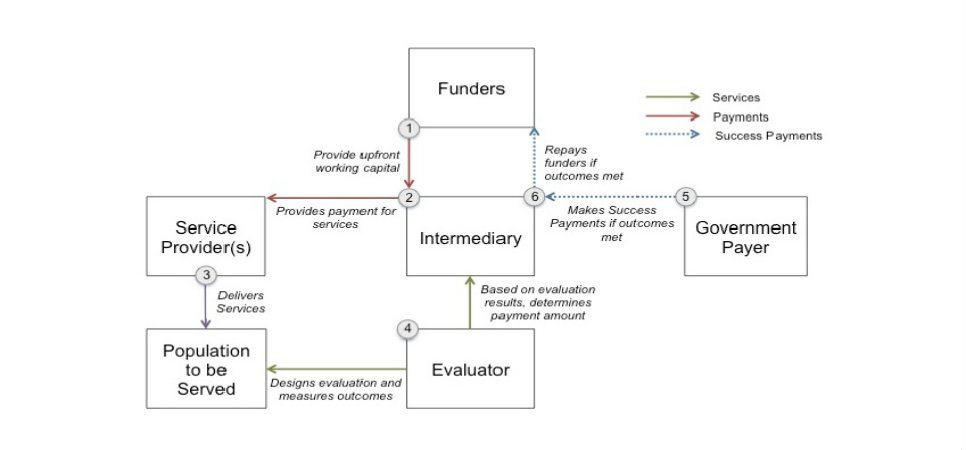

In an attempt to more effectively combat youth recidivism at the Rikers Island jail in New York, Goldman Sachs and Bloomberg Philanthropies launched the first Social Impact Bond (SIB) in the United States in 2012. The program provided cognitive behavioral therapy to youth at Rikers in an attempt to reduce their likelihood of returning to jail. Unfortunately, the new therapy didn’t work to reduce recidivism at Rikers, so the program has ended, and Goldman Sachs and Bloomberg Philanthropies have lost their $7.2 million investment.

Technically, the SIB worked: the program didn’t generate results, so taxpayers didn’t have to pay for it. Of course, we all hoped that the new intervention would have reduced recidivism. However, the pioneering model enabled government to experiment on providing a new and different service that might have led to better outcomes, but without the financial risk. This model of de-risking will hopefully lead to more innovation in provision of services even when government budgets are tight.

There was more positive news out of the UK, where three SIBs returned investor capital. Each of the three SIB partners—Career Connect, Teens & Toddlers and Advisa—met their goals, and investors received a financial return ahead of schedule. The nonprofits worked with Social Finance to improve educational participation for 4,000 teens through a number of activities, including job coaching and after school programs.

Better Outcomes at Lower Cost: Congressman John Delaney’s TEDx Talk on Pay for Success

Congressman John Delaney has been a consistent advocate for Social Impact Bonds and Pay For Success models as a means to address three challenges in government: lack of funding, inability to innovate and insufficient data on social impact. Watch Congressman Delaney’s call-to-action to “put aside the ideological divide” and “stand up for a smarter government” that can “intervene and make a difference in people’s lives but is focused on innovation, fiscal responsibility and focused on new ways of delivering its services.”

Goldman Sachs Asset Management Acquires Imprint Capital

In July, Goldman Sachs Asset Management announced its acquisition of Imprint Capital, an impact investing advisory firm. This acquisition highlights the growing need for impact investing experts within the traditional asset management field and a growing demand for products that consider environmental, social and governance as well as other impact metrics.

Millennial Entrepreneurs Get a Chance to Turn Ideas Into Reality

The Case Foundation is a proud sponsor of the Forbes $1 million Change-the-World Social Entrepreneurs Competition, which will identify and reward young social entrepreneurs leading for-profit and nonprofit social enterprises that address global challenges. This competition presents an opportunity for bright minds under 30 to change the way we approach social issues of our time. If you’re under 30 and changing the world, or you know someone who is, please apply! The deadline is August 26.

Excited about the news and want to learn more about impact investing? Follow our twitter feed @CaseFoundation, and check out the Case Foundation’s A Short Guide to Impact Investing.