For many years, SXSW has been the place to go to see the new thing, the new product, the new trend. Market leading products like Twitter took off when they launched at the annual Austin conference and hit shows like Game of Thrones and stars like Jay Z have flocked to Austin to join in the fun and be associated with the newest trends.

Each year as I head to SXSW, I can’t help but wonder what the “next big thing” might be that will have the conference abuzz. This year, it wasn’t a product and it wasn’t a personality. Instead, it was a powerful idea: double down on the secret sauce that has made America great by expanding the pool of entrepreneurs who are building great companies and bringing new innovations. And while the idea itself may seem simple, the potential for transformative impact is extraordinary. And for any investor, this idea represents a potential new source of innovation, talent and access to untapped markets.

This was my message and the message of the Case Foundation as we went to SXSW, but we didn’t expect to find similar sentiments echoing from the SXSW stage throughout the conference, in hallway conversations and at cocktail parties. And it was the central message in my fireside chat with Reena Ninan of CBS News. Like any “hot” issue, there is usually some arresting set of facts that serves to ignite passions. In this case, the data is so stark that it provides a great entrée for the topic more broadly. Consider this data on the state of venture capital investing in the United States:

- 78% of venture capital goes to just 3 states—California, New York and Massachusetts;

- 90% of that venture capital goes to companies founded by men, leaving just 10% going to female founded companies

- Only 1% of this venture capital is going to African-American founded companies

At the same time, women owned firms are growing 5 times faster than the national average. And a growing body of data reports that both women-run firms and firms with diverse teams, outperform their counterparts. First Round Capital, for instance, reported when it separated out performance in its portfolio of companies, it found that female-led firms outperformed their counterparts by 60%. Traditional investing is starting to realize that perhaps diversifying leadership is a business imperative to boost performance, with the point driven home most clearly from State Street Global Advisors, with trillions of dollars of assets under management, State Street placed a bronze statue of a young girl staring down Wall Street’s bull, and matched it with a message that they will use their proxy power if needed to ensure those firms in their portfolio diversify leadership. Sure, investing in more women and people of color is a social justice issue, but it is also a powerful economic opportunity for investors and for our nation.

This was the topic of a Ted Talk I gave a few months ago and it was great to see the SXSW attendees engage so eagerly on this subject—from world-class investors looking for paths to these untapped segments, to reporters hearing from more diverse voices and perspectives on the panels they led, to entrepreneurs from these segments asking how they can find the funders who get this and are willing to listen to good ideas, no matter the gender, color of skin or geography.

And I was not alone at SXSW in talking about these issues.

- Beth Comstock, Vice Chair of GE, spoke eloquently about the efforts GE was taking to look for great ideas in more diverse places and how they were building more flexible workplace rules so all could succeed at GE.

- Aspect Ventures founding partner Theresia Gouw, BBG Ventures President and managing partner Susan Lyne, and Joyus founder/CEO and angel investor Sukhinder Singh Cassidy joined Fortune senior editor Kristen Bellstrom on a panel on Monday to talk about the lack of diversity in VC funding for women and share suggestions about steps to take to change the status quo.

- Dan Lyons, a tech journalist, former Silicon Valley screenwriter and author of the New York Times best-seller, “Disrupted: My Misadventure in the Startup Bubble” spoke in his SXSW panel about how “bro culture” and bias were holding back the industry and how we had to change the way they thought about hiring and promoting to ensure our most actively funded companies did not become too insular.

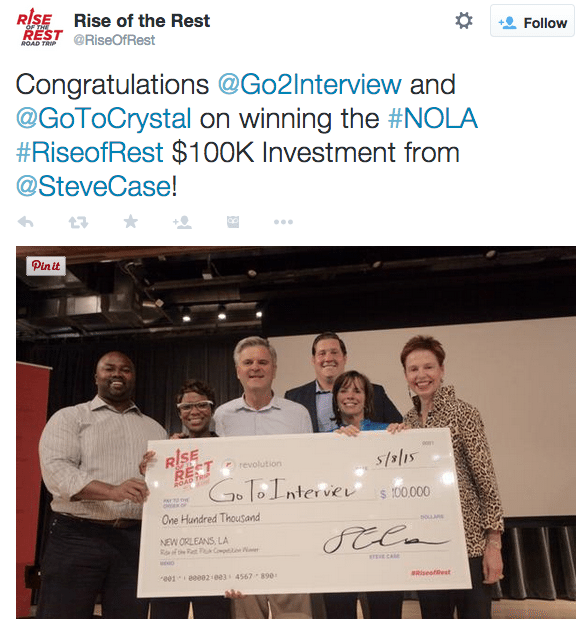

- And Case Foundation chairman (and my husband), Steve Case, talked about the “Rise of the Rest” initiative that he runs separately from the Foundation, spotlighting and funding entrepreneurs across America, from places between the coasts that investors often ignore, but where the vast majority of our Fortune 500 companies in America were started.

And the programing and general conversation around SXSW supported this yearning for more leadership and support for a wider community of innovators. At the National Geographic venue on 6th street, National Geographic Explorers who came from non-traditional backgrounds were greeted by thousands of SXSW attendees. These included Albert Yu-Min Lin, who spoke about maintaining his passion for exploration after losing a limb, and how those in the field have the responsibility to tell the stories and make a difference. David Lang, who is designing and building underwater robots that are being used by citizens to explore oceans, rivers and lakes in ways that have never been accessible to non-academic and government officials; and Erika Bergman, who leads Google Hangouts as she pilots her submarine so all can get the chance to see the discoveries she is making thousands of feet underwater. All of these Explorers leveraged their unique backgrounds and passions to explore in ways that were outside the norm, bringing new perspectives to their work and opening doors to citizen science that had previously been closed.

Finally, this call for a wider pool of innovators was echoed by Vice President Biden as he made an impassioned plea at SXSW to support cancer research. He called on SXSW attendees to use their diverse skills and backgrounds to participate in cancer research, trials and to lend their minds and access to improve detection, prevention and treatment of cancer. In calling on more innovative thinking and engaging more diverse participants, Vice President Biden said “If we did nothing more than break down the silos preventing greater collaboration because of the way the system has been built up—not intentionally—over the last 50 years, we can extend the life of a lot of people with cancer.”

While SXSW is often known for opening our eyes to new products, this year’s SXSW was a venue where the message was clear: the next undiscovered big thing is people and the innovations that those not traditionally in the mainstream can bring to the table. Frankly, it was a breath of fresh air and we, at the Case Foundation, stand ready to keep the momentum started at SXSW going so we can see real change in the faces and ideas of the innovators who power the next generation of ideas.